Background: 4C Strategies has been working with the Swedish government-owned SBAB Bank for many years. This has, amongst other things, included risk management support and holding crisis management training and exercises for the central crisis management team and the Board. In 2014, SBAB Bank decided to phase out the use of spreadsheets for operational risk management and use a digital solution instead. 4C had the optimal solution in Exonaut®.

Challenge: Help SBAB digitalise operational risk management to better meet stricter regulations, provide an organisation-wide common risk understanding, and support the implementation of new risk methodologies.

Solution: Exonaut Risk Manager delivers a systematic approach to enterprise-wide risk, according to the ISO 31000 standard, in an information-rich and user-friendly desktop and mobile solution. Exonaut is featured in Gartner’s 2020 Hype Cycle for Risk Management report.

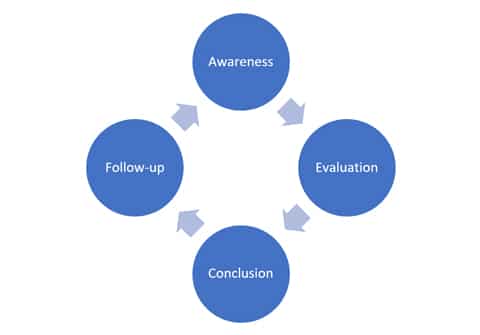

Benefits: SBAB can follow a structured risk framework throughout the risk lifecycle and control, communicate and mitigate risk more efficiently at every level of the organisation using an innovative three-dimensional approach to risk evaluation.

Customer: SBAB bank offers mortgages and savings options to consumers, businesses, and tenant-owned housing associations. It is wholly owned by the Swedish government and employs around 750 staff.