Today, there are new demands on risk management to act as an enabler for better organisational and business decisions. However, outdated traditional models don’t support those organisations or business units that operate and indeed thrive under inherently higher risk conditions. At 4C Strategies we have developed a new model that empowers risk owners and challenges senior management to look at risks from a different perspective. And the results speak for themselves as enterprises begin to see new opportunities and improved financial returns.

Ansgar Toscha, Principal Consultant at 4C Strategies, has over 20 years of experience as an ERM/GRC supply chain risk management consultant and is the the author of ‘An Introduction to Enterprise Risk Management’. Throughout his career, he has advised global enterprises and smaller scale companies from a diverse range of business areas and industries.

We speak to Ansgar about why risk management is so important and how the 4C risk management model can help with better business decision-making.

“There’s a sense of frustration among senior managers that risk management isn’t acting as an enabler for better business decision making. It’s time to align risk appetite; time for a risk management model for a new decade.”

Ansgar Toscha, Principal Consultant at 4C Strategies

Hi Ansgar, can you tell us why risk management is important?

In short, risk management is essential to raise risk awareness throughout an organisation and improve decision-making at all levels. Organisations that should practice effective risk management include those that:

- operate in complex business environments

- run complex product portfolios

- are in heavily regulated industries

How is the traditional risk management model applied?

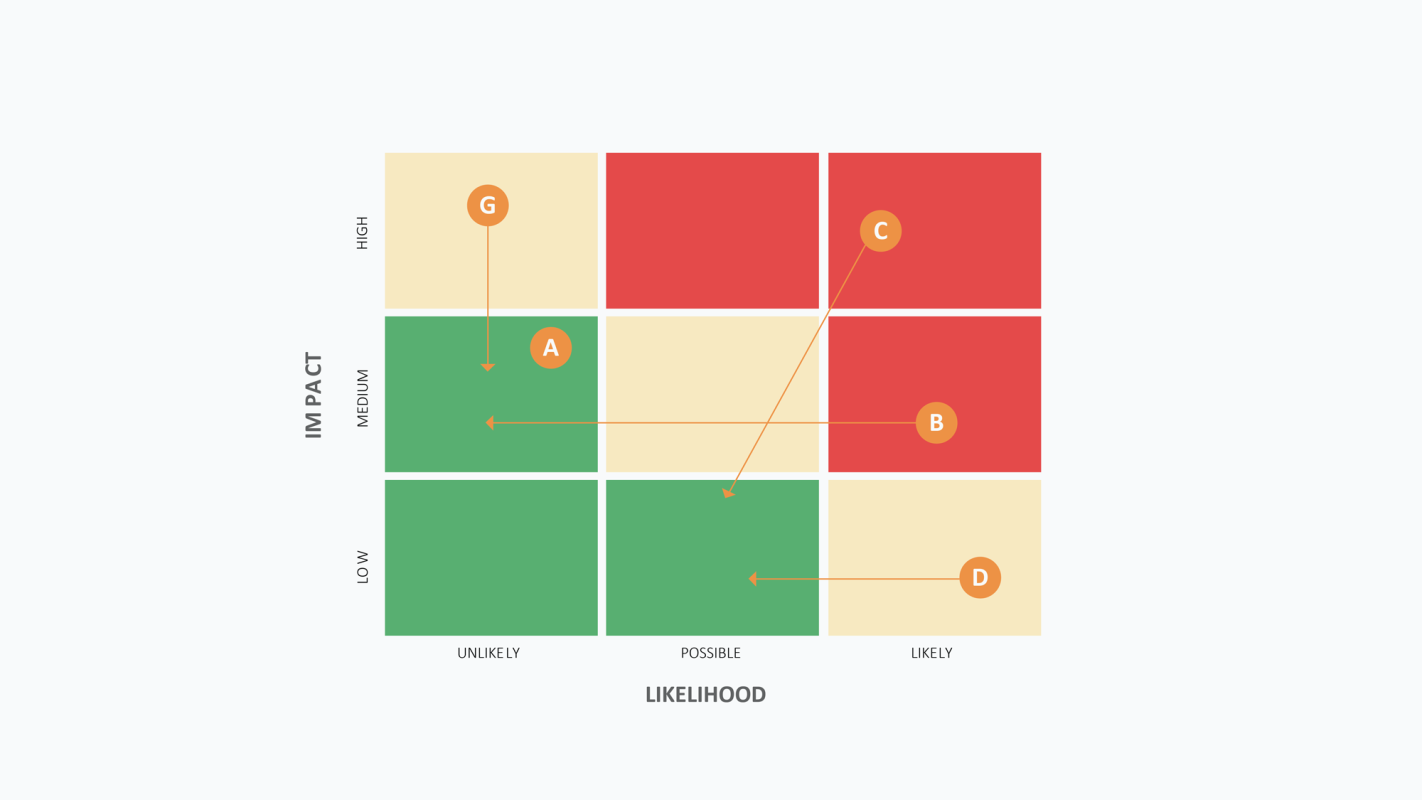

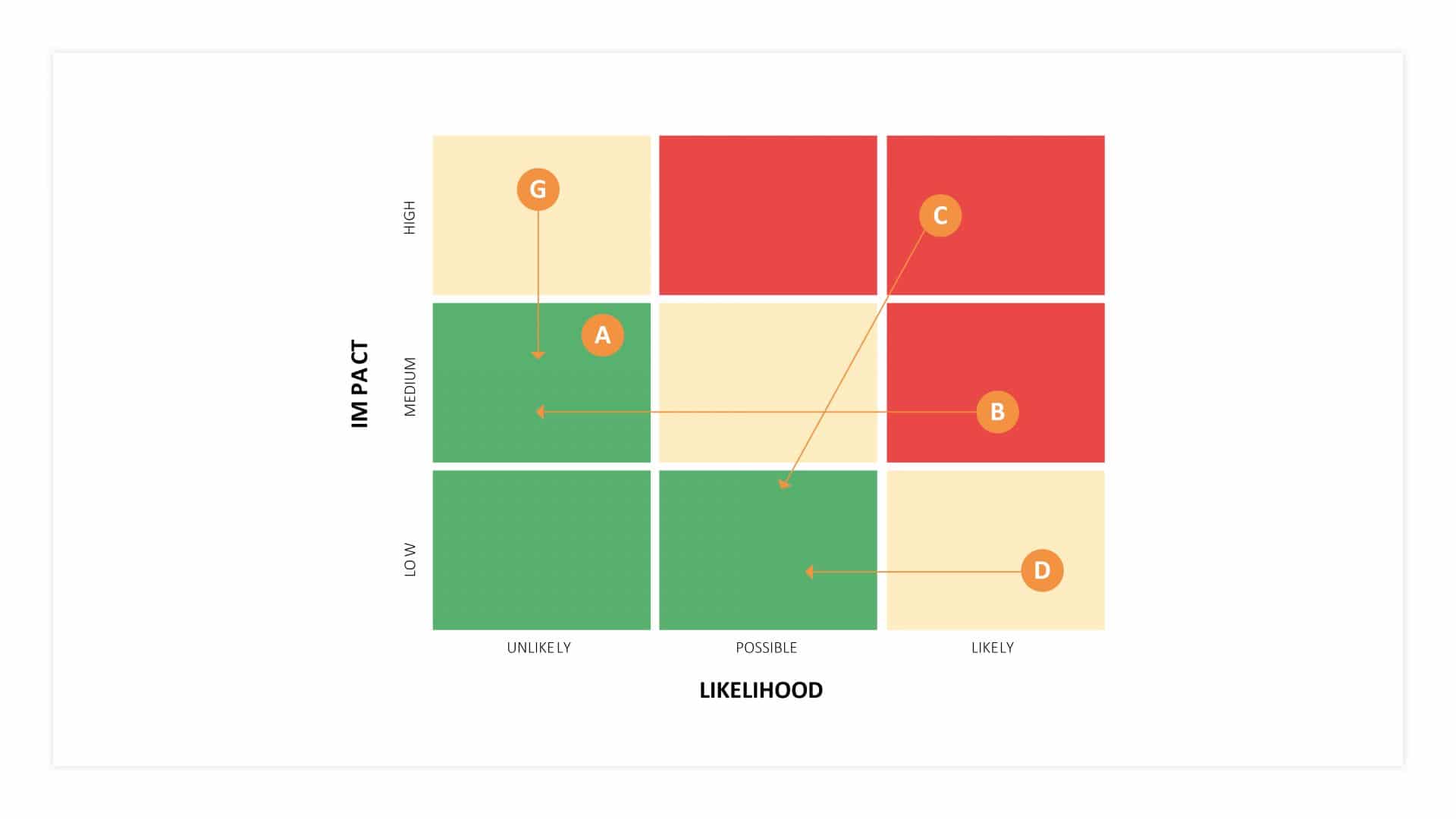

In the traditional model used by many organisations today, you identify critical risks and then plot the likelihood of them occurring as well as the impact they will have on the organisation. This includes:

- strategic risks

- operational risks

- financial risks

- compliance risks

Based on this, you define a strategy to move risks from the red and yellow zones to the green ‘safety zone’.

Why is this model inadequate for many organisations?

Many organisations today operate multiple business models, which have fundamentally different levels of risk appetite. This isn’t supported in the traditional risk management model, which has one clear aim – mitigate risks. Why? A business unit with an inherently high risk appetite, may have no alternative but to operate outside the green zone and may even be happy to do so because it has control of the risks. Additionally, some organisations have a proven track record of being successful at responding to risk, but a poor one at evaluating risk, in particular when assessing likelihood. The model simply doesn’t cater for them.

You often meet with senior management in your role, what do they have to say about this?

There’s a sense of frustration among senior managers and board members. Many feel that risk management isn’t acting as an enabler for better business decision making. They encounter the same traditional model again and again which means the conversations around risk remain the same.

“Simply lowering the likelihood of risks occurring isn’t the answer, especially as the reason a risk is identified in the first place is often because it already happened at some point. Instead, align your risks with risk appetite, and make sure you have adequate control of them.”

Ansgar Toscha, Principal Consultant, 4C Strategies

You mentioned control earlier, why is this so important?

Control is missing in the traditional risk management model. If you are in control of a high risk, i.e., something in the red zone, you could argue it is no longer a high risk, even if it would have a critical impact on the organisation if it occurred.

What advice would you give to organisations looking to get more from risk management?

You need to challenge the status quo, as we have done at 4C Strategies. Simply lowering the likelihood of risks occurring isn’t the answer, especially as the reason a risk is identified in the first place is often because it already happened at some point. Instead, align your risks with risk appetite, and make sure you have adequate control of them.

Is this what organisations can expect to do when using the new 4C Strategies model?

This and much more. The new model changes the conversation around risk and helps organisations take better business decisions. It also provides an ‘at a glance’ overview of the actual effectiveness of risk mitigation over time.

Is the model in use?

It is already being applied by global enterprises and some smaller businesses, with great results. At one company a board member commented “Obviously, risk X equates to a big exposure for us, but as long as we are in control of it and it generates a lot of income, I have no problem with that!” The traditional model wouldn’t trigger this kind of comment.

How can organisations find out more?

We have produced a short paper on it which can be downloaded below. This provides more detail on the model including a simple business example. If an organisation is looking to make better business decisions with risk management then they should contact us directly, and we can help them drive this process using our new model.

Read more about risk management and our risk management software

Thank you for downloading!

The resource will be sent to the given email address. You are welcome to contact us with any question you may have.

Name*

Company*

Email*

checkbox is required

To learn more about how 4C Strategies process data, please read our

I agree to be contacted for the purpose indicated above, and to receive information about 4C Strategies’ products, services and events.

Thank you for downloading!

The resource will be sent to the given email address. You are welcome to contact us with any question you may have.

Name*

Company*

Email*

Phone number

checkbox is required

To learn more about how 4C Strategies process data, please read our

I agree to be contacted for the purpose indicated above, and to receive information about 4C Strategies’ products, services and events.

DOWNLOAD RESOURCES

4C White Paper – Take Control of your Risk Management

4C Solution Brief: ISS Risk and Compliance Management

4C White Paper: Improving Local Resilience Forum’s Ability to Manage Risk

4C Strategies COVID-19 Support

As coronavirus-related needs and demands continue to evolve, 4C Strategies is offering specific pandemic support for our clients and wider network. This includes advisory services such as mid-incident COVID-19 reviews, additional operational resources (onsite or virtual) for risk, business continuity and crisis managers, and pre-configured software solutions to securely track, verify and visualise response efforts.

Read more →