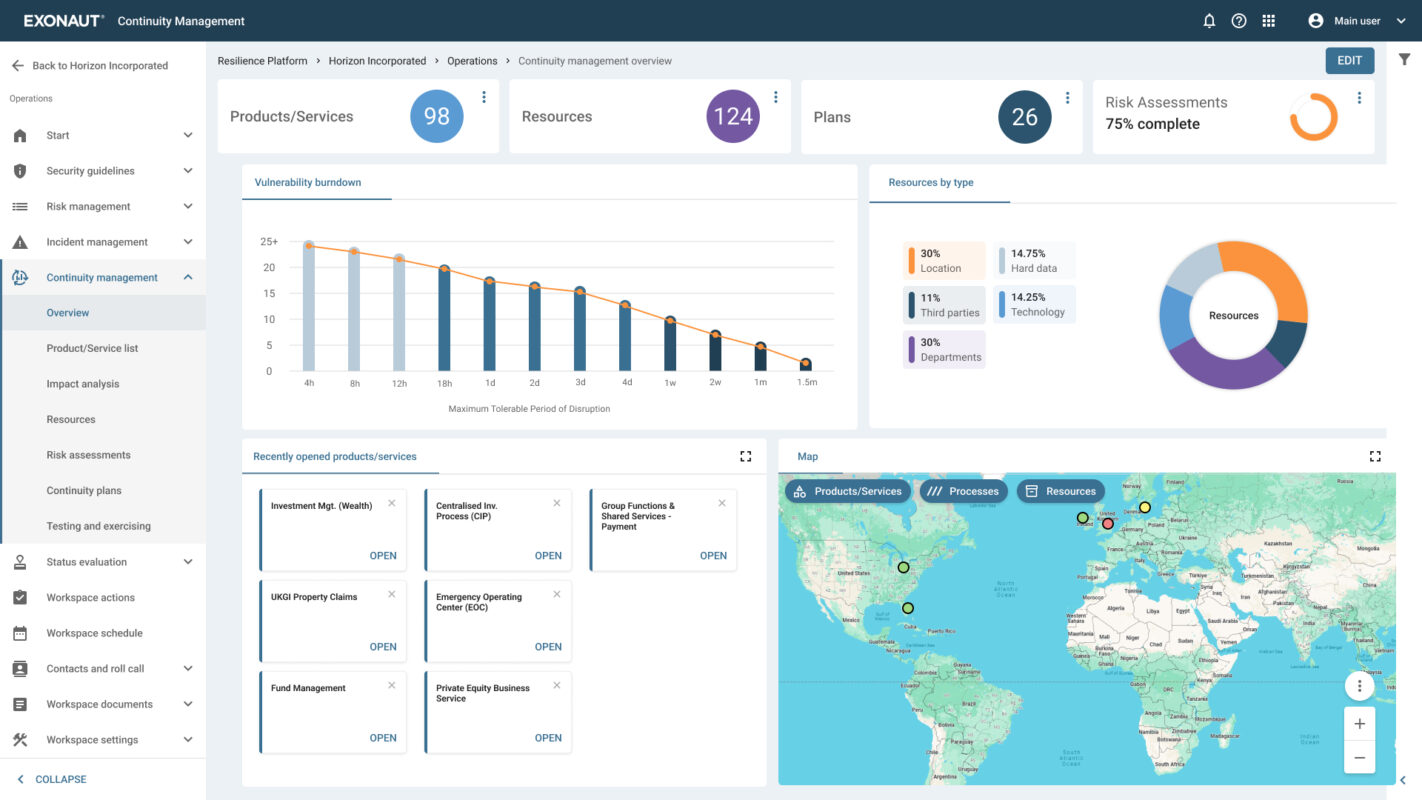

In today’s unstable times, effective continuity management is essential to safeguard assets and maintain operations during disruptions. Continuity Manager provides a robust and adaptable framework designed to ensure comprehensive business continuity and resilience planning. It enables organizations to maintain operations during disruptions by effectively identifying, managing, and monitoring critical services. Watch the video to discover more.

We understand the unique, multifaceted regulatory and operational challenges and complexities faced by the financial industry. Working with local and global finance firms, our experience spans banking, insurance, regulatory bodies, and critical service providers. This extensive experience allows us to view and address challenges from every conceivable angle, providing our clients with software and services that are innovative, relevant and globally informed.

Supporting customers around the world

Our resilience software is used by Fortune 500 financial firms to boutique banks to plan for, prepare, predict, respond to and recover from incidents and emergencies. The scalable, user-friendly software is available in standalone solutions or as a fully integrated resilience ecosystem. It provides a competitive advantage for finance firms looking to implement AI assisted, data-driven software for managing enterprise risk, improving continuity management and operational resilience, effectively managing incidents and crises, and identifying and closing capability gaps through training and exercises.

Integrated workflows adapted to standards and best practices and real-time data-driven insights ensure processes are streamlined, reporting is automated, collaboration and escalation is smooth, and firms can maintain operational stability, taking decisive and appropriate action when it matters.

Our consultants have been supporting the financial sector with wide ranging resilience services for over two decades. From central banks, FMIs and regulators to insurers and investment banks, we help teams, organizations, and regions increase their resilience. From developing and implementing standards and best practices, to identifying areas for improvement and running capability development training and exercises, we always deliver.

Many of our consultants have a background from the finance sector. They can examine a single aspect of your organization’s resilience, such as risk management, IT resilience, compliance, business continuity, and crisis management, or take a more integrating approach. 4C also excels in training and exercising, helping financial firms and organizations around the world build resilience.

With the introduction of the Digital Operational Resilience Act, DORA, changes in NIS2 and other similar regulations, having a software adapted to specifically support these regulations is invaluable. Our Continuity software is used for Operational Resilience by leading financial firms to automate and uphold continuity, important business service mapping, testing, strengthening and reporting on critical assets, as well as their risks, tolerances, and dependencies.

If a severe operational disruption occurs, users can instantly see what is impacted, who the process owner is, how much time they have to respond, and what preplanned actions should be taken

Learn more

Build on your organization’s resilience capability with our Business Continuity Program Implementation. Tailored to the unique needs of your organization, this program ensures that you are well-prepared and equipped to maintain critical operations, no matter the challenge. We also offer BCM and Resilience Health Checks focusing on regulatory requirements or to provide a benchmarking perspective to measure your standing against industry peers. Our goal is to ensure your financial organization not only meets but exceeds the required capabilities for resilience and business continuity.

Learn moreIn times of crisis, a swift and effective response is paramount. Our incident and crisis management solutions equip financial organizations with the tools and strategies needed to handle incidents and crises rapidly and efficiently. From initial detection to an insight-driven response and recovery, our software ensures that your team is prepared to manage any relevant crisis, minimizing impact, and preserving your institution’s integrity and reputation.

Putting Our software at the center of any response, ensures smooth and effective collaboration, improved decision-making, and full transparency for after event reviews.

Learn more

It is critical to ensure that the organization’s response capabilities meet the requirements of an organization or industry, and can tackle the threats, disruptions and crises they may encounter. To do that you must know what your capabilities are, what areas should be prioritized for development, and how to achieve that.

Our experts support many financial firms using our software as part of an end-to-end development program. Based on what good look likes at your organization and industry benchmarks, we tailor a program of training and exercises, be it desktop or full-scale scenario exercise to continuously increase the capabilities of your organization. Identifying what good looks like across many resilience facets enables prioritization of capability development

Learn moreWhen a disruption occurs fast action based on critical facts can make all the difference. In Continuity Manager you are notified automatically, and can instantly see which critical services or operations are being impacted, as well as the different dependencies and their tolerance levels Find our how you can quickly invoke response plans to maintain operations by watching the video.

Latest News

Copyright 2025 © 4C Strategies

Manage disruptions

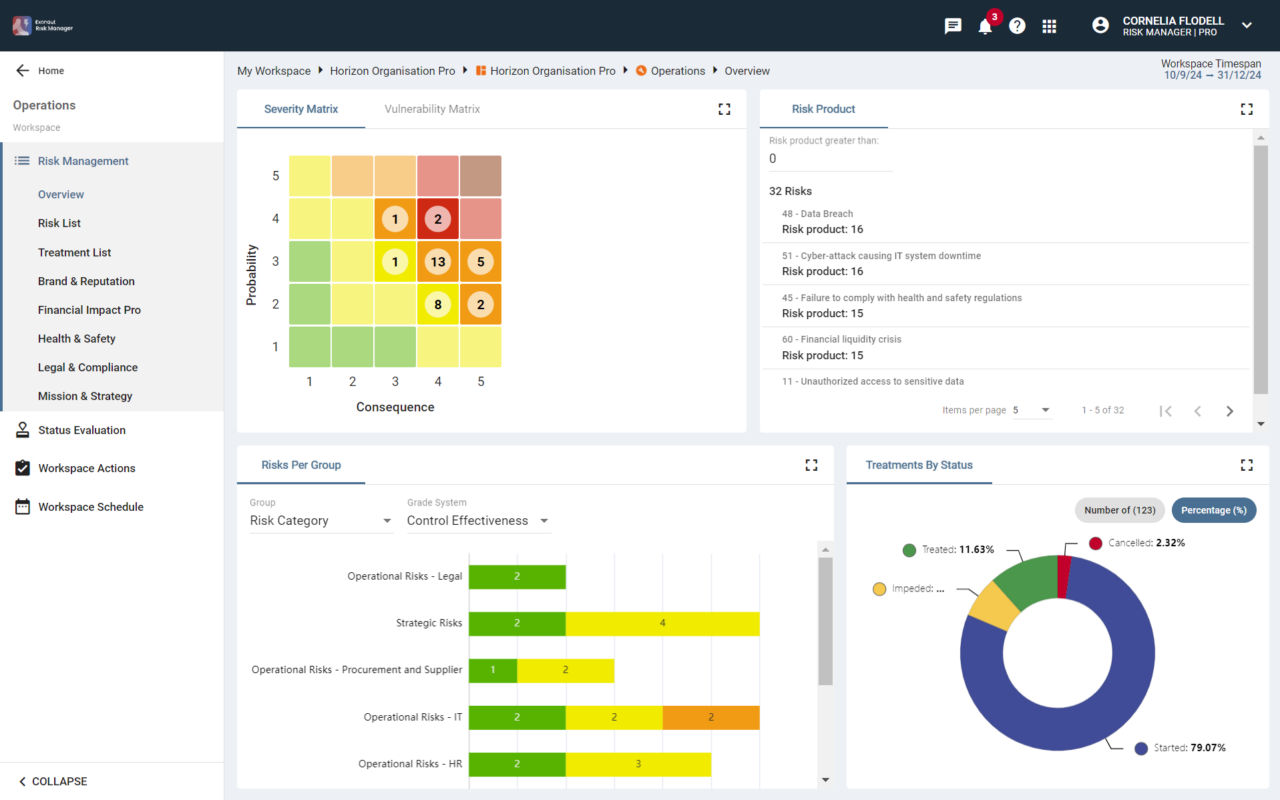

Control your risks

Handle crises fast

Run training exercises